PowerSchedO for XBID

The “Cross-Border Intraday Market Project” also known as XBID

is an initiative lead by several European power exchanges in order to increase the efficiency of the intra-day market enabling continuous cross-zonal trading

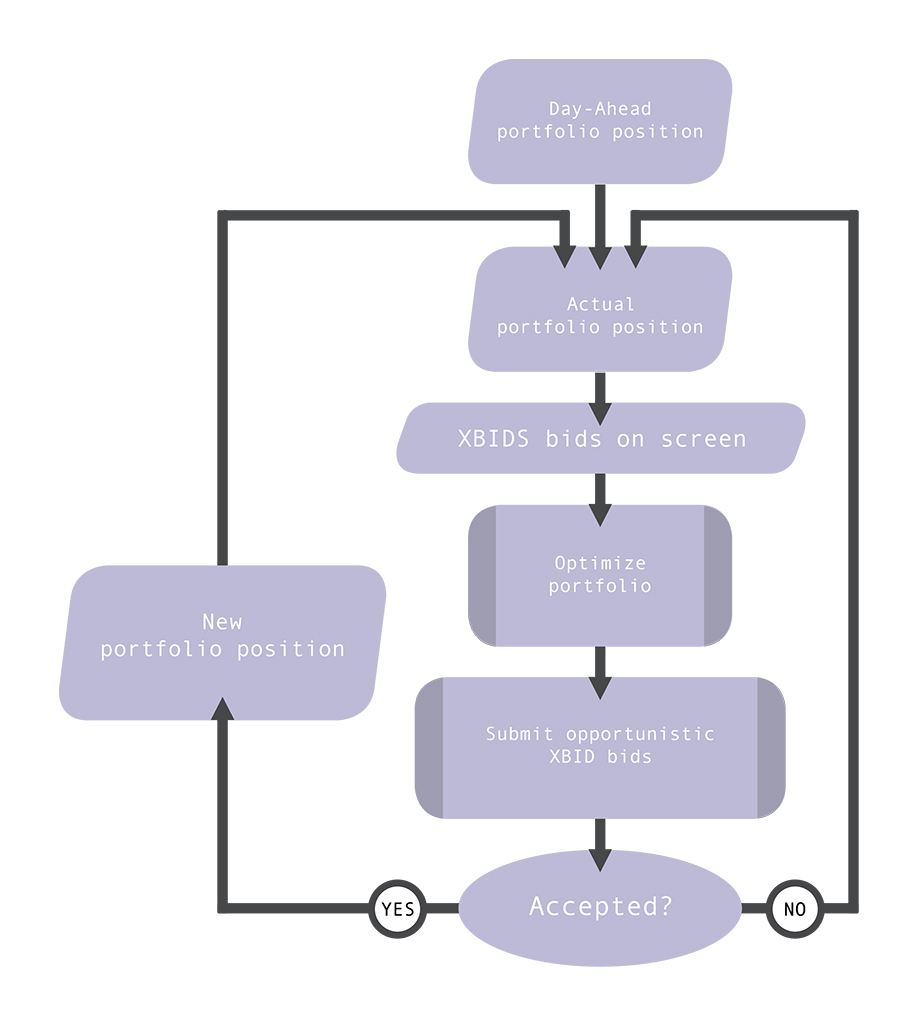

A single shared order book

Visible from all the operators across Europe, supporting a continuous trading environment. Any participant can submit orders that are accepted and execute if there are other appropriate matching orders.

A capacity management module

Holding all the available transportation capacity from any hub to any other hub, i.e. the so-called hub-to-hub matrix.

In the following sections

we are going to describe how PowerSchedO for XBID can help the participants to efficiently trade on XBID considering the opportunity given by the shared order book and the capacity management module.

Opportunities from the Shared Order Book

Many European power operators have different assets on several hubs: OMIE, EPEX, BELPEX, etc. The assets include wind and solar generation, virtual power plants, pumped storage plants, thermal generation, power storage, and maybe other flexibility sources. After the day-ahead energy market, any single asset has:

A planned status, i.e. the production level for a CGTG

Due to the transportation network and the block orders, the assets are much dependent on each other. For example, think about how renewable production and chemical power storage are synergistic.

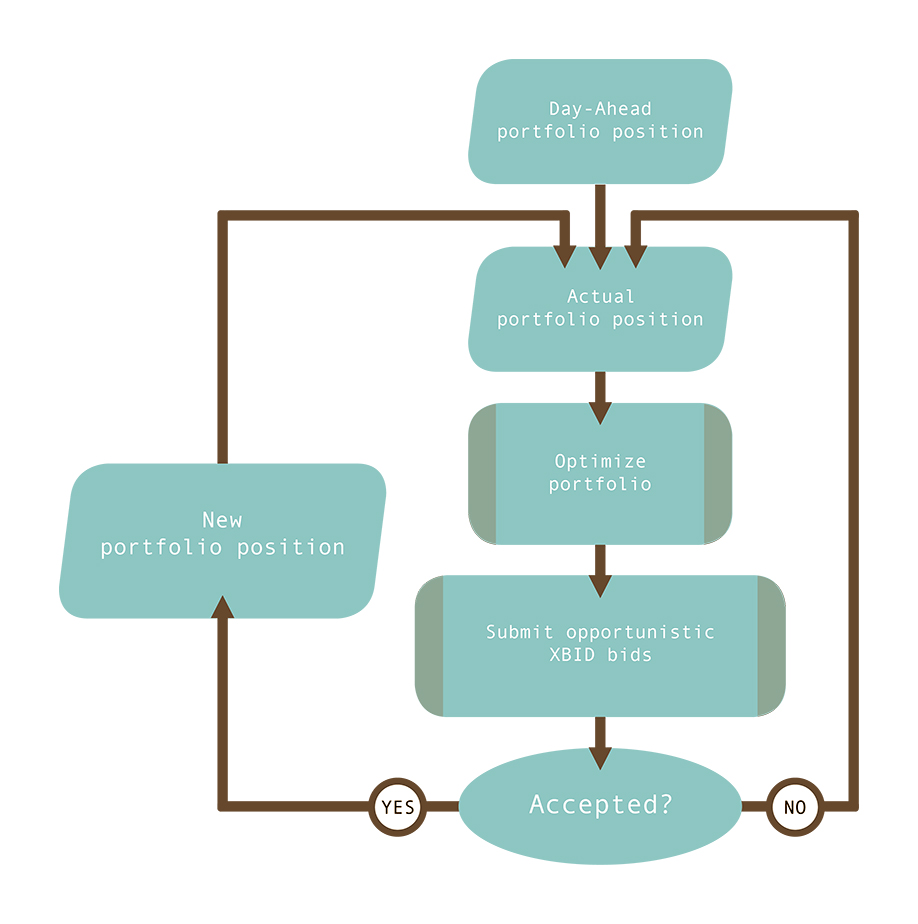

A power portfolio optimization that spread across Europe and takes into account how assets are positioned after the day-ahead, all the costs, the constraints and the strategic objectives, can be very useful to automate two different streams of operations on XBID:

the submission of orders and the acceptance of orders.

Automatic submission orders

Between the closure of the Day-Ahead and any single delivery, many things changes: the renewable productions, the energy demand, an unexpected breakdown, and many others. For this reason, the asset position that was optimal on the Day-Ahead market, it can lead also to a loss at the delivery, unless some adjustments.

An integrated optimization portfolio can identify the bids to submit on XBID in order to match the objective of a better position, in term of a higher profit respecting all the portfolio constraints.

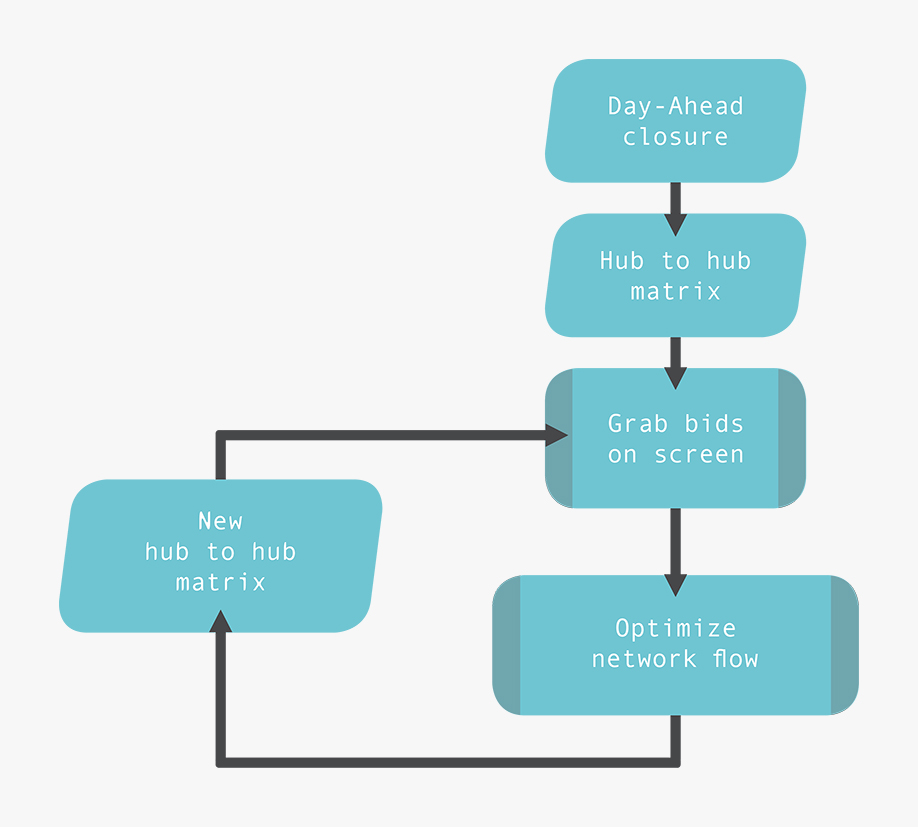

Opportunities from the Capacity Management Module

Electricity flows across the European hubs over a transportation network. Having enough available capacity across the network is a necessary condition in the bids matching. For this reason, the so-called hub-to-hub matrix – H2H – provides valuable information to XBID participants.

Before the closing of the day-ahead market, any TSO provides the available transportation capacity for its piece of the network. All this information become an input for the Euphemia algorithm that will match bid and ask curves providing prices, volumes and flows.

PowerSchedO for XBID, using a replica of the Euphemia algorithm, is able to replicate the official results providing the resulting H2H matrix. This is a practical result because we have a mathematical model of the transportation network. Indeed, we properly consider the ATCs and flow-based networks. With the same network mathematical model, the system is able to update the H2H matrix in real-time, whilst the bids are matched on XBID.

Contact us – PowerSchedO for XBID

PowerSchedO

for XBID

You will enjoy two main advantages

- Global and integrated portfolio optimization, supporting the generation of the submission orders and the acceptance of prompted orders

- Updated H2H matrix that supports your trading tactics